The Growth of Green Product Certification in China

Author: Steve Kooy

The Chinese characters for “China” (zhong guo) – middle (中) and kingdom (国) – translate into a worldview that places China at the center of the world. This worldview is more of an economic reality than ever given China’s meteoric ascension to global powerhouse status. What does this mean for the green and sustainable products market?

Much has been written about three trends that are important in answering this question – growing affluence in China, the power of e-commerce, and the export of Chinese goods to the rest of the world. These trends, in turn, are creating a greater demand for truth in labeling, and driving the growth of third-party verification and validation. Let’s take a moment to take stock of where we are.

Purchasing Power

In just a few short years, the purchasing power of Chinese consumers has mushroomed. The Boston Consulting Group (BCG) recently reported that China’s consumer economy is projected to grow to $6.5 trillion USD by 2020 – nearly 50% in just five years, despite China’s recent slowdown (see summary reposted by the World Economic Forum). BCG and AliResearch, the research arm of Alibaba, projected that the rapid rise in upper-middle-class and affluent households will drive this consumption growth.

The Credit Suisse Research Institute’s “Emerging Consumer Survey” suggests a growing interest among Chinese consumers in purchasing premium (property, cars, jewelry) and “lifestyle” (sportswear, fashion) products, as well as foods viewed as supporting a healthier lifestyle. Changing demographics are also trending toward more sophisticated product choices. According to BCG and AliResearch, Chinese consumers under 35 tend to be better educated, more likely to travel overseas, more brand conscious, and willing to spend more than older Chinese.

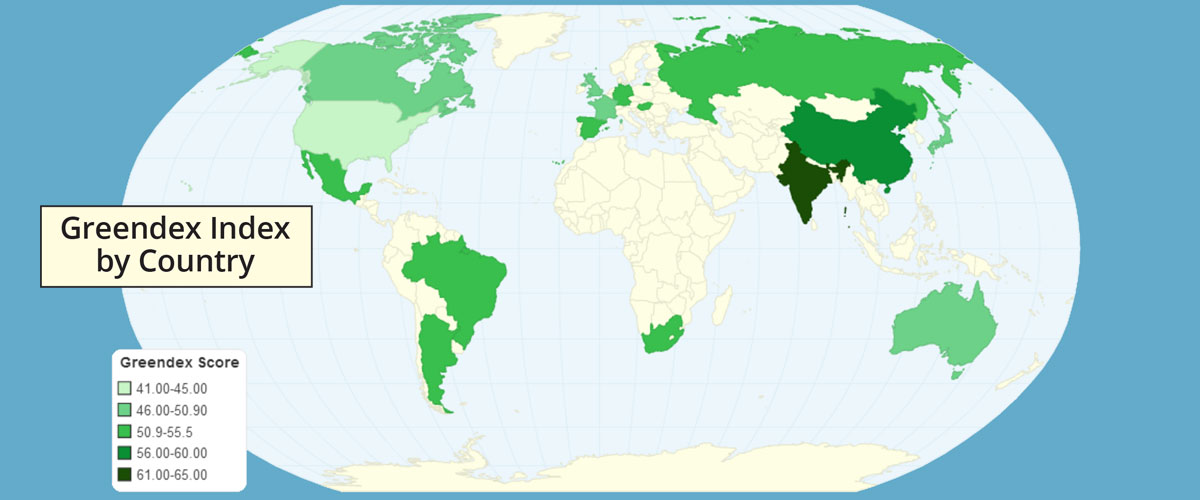

These purchasing trends correlate with the findings of the National Geographic/GlobeScan Consumer Greendex: Consumer Choice and the Environment – A Worldwide Tracking Survey. The survey, conducted five times between 2008 and 2014, has consistently ranked Chinese and Indian consumers highest – and interestingly, American and Canadian consumers lowest – in their sustainability behavior.

National Geographic/GlobeScan Consumer Greendex. Image and table providing country-by-country breakdown from: http://chartsbin.com/view/40806

Expanded Access through E-Commerce

Mirroring trends in Western consumer markets, e-commerce is rising sharply in China, opening new opportunities for manufacturers around the world to increase Chinese access to their products. According to the BCG/AliResearch report, online transactions have nearly tripled since 2010, now constituting 15% of private consumption. In particular, the younger, brand-conscious consumer is looking abroad for product options. According to Dr. Martina Gerst of the EU SME Centre in Beijing, Chinese shoppers spent a whopping $ 17.8 billion USD online during China's “Singles Day” last November.

Like their American and European counterparts, Chinese consumers increasingly want proof that the products they purchase pass muster. The Greendex 2010 survey reported on the lack of trust in company claims as a major barrier that needed to be addressed. “Savvy consumers are pushing for being adequately informed about the authenticity of products purchased via E-commerce, regardless whether these products are domestically produced or imported from abroad,” says Gerst.

The Flood of Chinese Products

China’s domination of the world export trade remains unparalleled. In 2016, China exported more than $2.1 trillion USD in goods around the globe.

At the same time, there have been some big bumps along the way. As the Washington Post reported in May, workers at the factory that manufactures Ivanka Trump’s clothing line have been working nearly 60 hours per week for wages near or below China’s minimum wage. Other incidents have surfaced for exported Chinese goods related to product quality, workmanship, working conditions, product contaminants, and environmental pollution. There is a clear demand from overseas customers and Chinese consumers alike for greater scrutiny and accountability.

Importers sometimes find themselves caught in the middle. Fredrik Grönkvist, an importer with ChinaImportal.com, provides useful cautionary tips in his blog entitled Importing from China? Don’t neglect the certification requirements.

Third-Party Certification Is Revving Up

To their credit, a growing number of Chinese manufacturers, from start-ups to multi-national brands, have taken this challenge to heart. In response to these three trends, companies across the Chinese economy are seeking third-party certification, validation and testing to demonstrate their conformance with selected ecolabeling standards.

For instance, in the building products sector, SCS is currently conducting indoor air quality certifications of flooring products in China under the FloorScore® and SCS Indoor Advantage labels, responsibly managed forest and chain-of-custody certifications for timber and wood products under the Forest Stewardship Council standard, and certification to California’s strict formaldehyde emission standards forcomposite wood products (CARB ATCM, Section 93120). With representatives in China, SCS anticipates a much broader scope of certification opportunity on the near horizon.

Moreover, just three years ago, the green building as a whole got a big boost when China’s State Council Green Building Action Plan mandated that public buildings, including schools, hospitals, museums, sports arenas, public housing, and many other large buildings, must meet China's 3-Star Rating System, GBEL (Green Building Evaluation Label). Its six categories of assessment include land, energy, water, resource/material efficiency, indoor environmental quality and operational management.

In the food sector, “clean” food certifications, such as Non-GMO, organic, and no artificial ingredients, are gaining traction, with 80% of consumers surveyed saying they have started eating healthier diets, according to the Credit Suisse survey. Other internationally recognized certifications, such as the Roundtable on Sustainable Palm Oil (RSPO) standard, are poised for expansion in China, not only for the vast array of processed foods made with palm oil, but for the huge cosmetics and body care products sector, and for biofuels.

Apparel, footwear, and textiles are three more high-visibility sectors that are undergoing changes in light of public concern. The Sustainable Apparel Coalition, a global alliance of apparel, footwear and home textile brands supporting sustainable production, has reported that more than $1 billion USD is estimated to be spent on social compliance audits annually in China, not including indirect costs such as staff time. The Coalition has piloted third-party verification of its facility environmental module within its Higg Index, a set of online self-assessment tools aimed at helping manufacturers, brands, and retailers make informed decisions about supply chains, product design choices, and overall sustainability performance goals.

And of course, the entire electronics sector is under close scrutiny, following on the heels of reports of poor working conditions at manufacturing plants supplying such well-known brands as Apple. While most of today’s certifications focus on hazardous material content, functionality and safety (RoHS, CE, FCC), ethical treatment and environmental certification is probably not far behind.

There are many challenges in conducting third-party verification in China. We look forward to sharing more with you about some of those challenges in a follow-up article.

Steve Kooy is Director, Sales and Marketing in SCS Global Service’s Environmental Certification Services Division. He can be reached at [email protected] or by calling 1.616.443.5053.